- Products

- Our products

- Preqin Pro

Alternative assets data platform

- Preqin Insights+

Institutional research

- Term Intelligence

Benchmark LPA terms

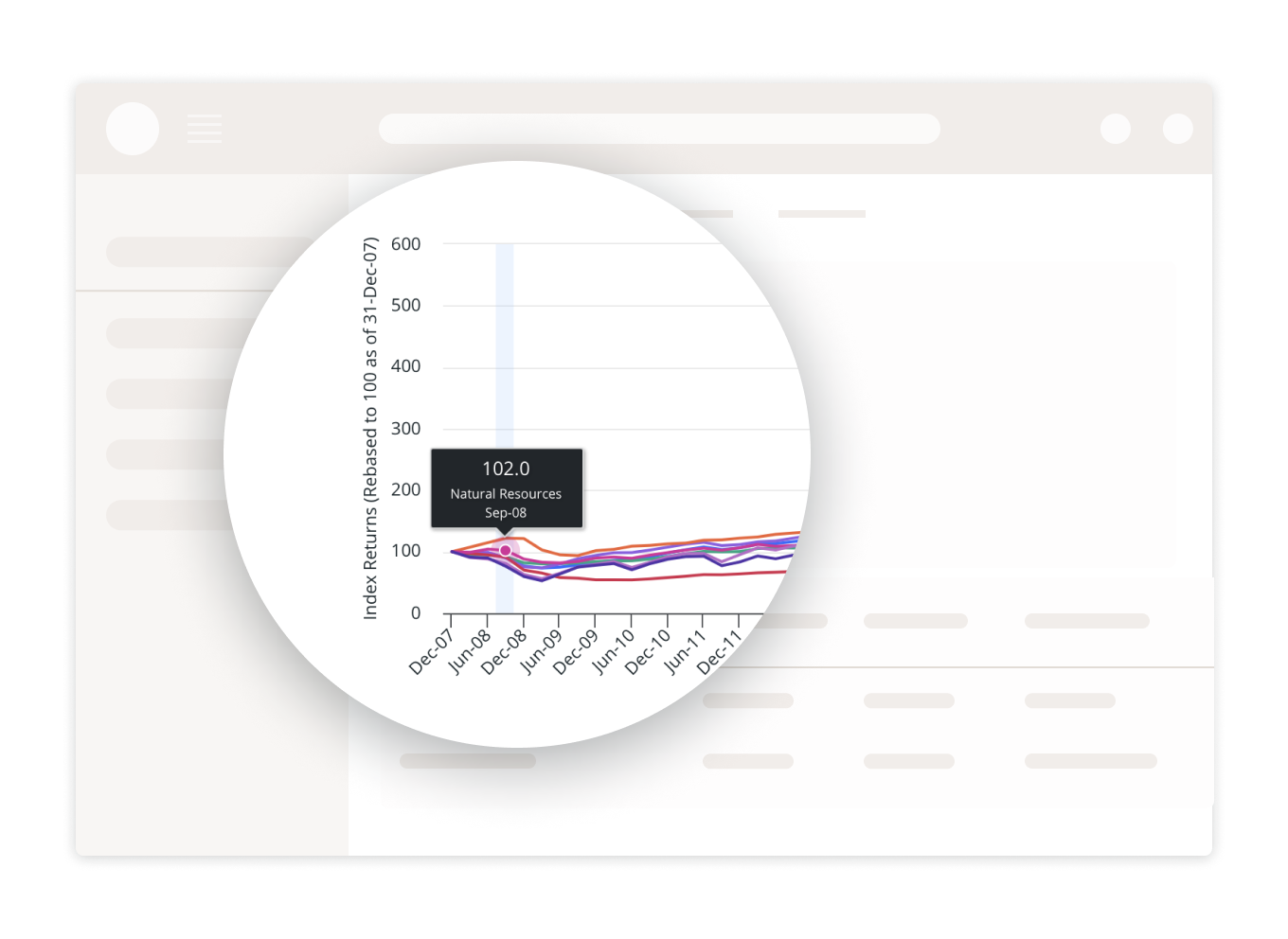

- Preqin Benchmarks

Industry's leading performance data

- Preqin Pro

- Preqin Sustainability

ESG data and insights

- Company Intelligence

Companies & deals data

- Enterprise Data Solutions

Flexible data delivery solutions

- Transaction Intelligence

A $5.4tn transaction repository

- Preqin Sustainability

- Allocator Hub

The end-to-end private markets analytics platform

- Customer testimonials

What our clients say

- Allocator Hub

- Quick Links

- Solutions

Solutions For

our clients

- Quick Links

- Insights+

- Private markets research

- Homepage

Browse reports

- Search

Search the research library

- Webinar recordings

Join conversations with our analysts

- Homepage

- Meet the analysts

Meet the team behind the reports

- Learn more

Learn more about Insights+

- Meet the analysts

- Quick Links

- News & content

- News & content

- Resources

- Free Benchmarks

See Preqin Benchmarks in action

- Data coverage map

Interactive map of Preqin's data coverage

- Preqin Profiles

Key investor, manager, and company data

- Free Benchmarks

- Preqin Academy

Lessons in alternatives

- Compensation calculator

Private capital salary information

- Preqin Academy

- Quick Links

- About

About

Our Company

Connect

With Us

- Quick Links

- QuickLinks